Confident Numbers for Hands‑On Leaders

Simplicity That Survives Busy Weeks

Anchor Assumptions, Not Every Line

Start by naming the handful of variables that truly move results: average order value, weekly leads, conversion rate, fulfillment capacity, and cash collection timing. Everything else can be grouped. Anchoring on a few controllable assumptions makes updating fast, conversations focused, and decisions obvious when trade‑offs inevitably appear.

From Gut Feel to Repeatable Rules

Your instincts are valuable, but turn them into rules the team can apply without you. Define simple if‑then guidelines for pricing, hiring triggers, reorder points, and discount limits. When rules mirror your judgment, people act faster, you review less, and numbers become a steady guide instead of a quarterly surprise.

Anecdote: The Café That Cut Waste

A neighborhood café stopped forecasting by dish and instead tracked three weekly drivers: foot traffic, average ticket, and waste percentage. By updating those every Friday, they halved expired inventory in two months and freed cash for a second espresso machine that paid back in one holiday season.

The One‑Page Budget You’ll Actually Open

Rolling Forecasts That Evolve With You

Cash Comes First: The Thirteen‑Week View

Turn Everyday Data Into Signals

Routines, Roles, and Cadence That Stick

Owner’s Hour: The Friday Finance Check‑In

Team Huddle: Metrics and Moves

Tools and Templates That Don’t Get in the Way

Spreadsheet First, Apps Later

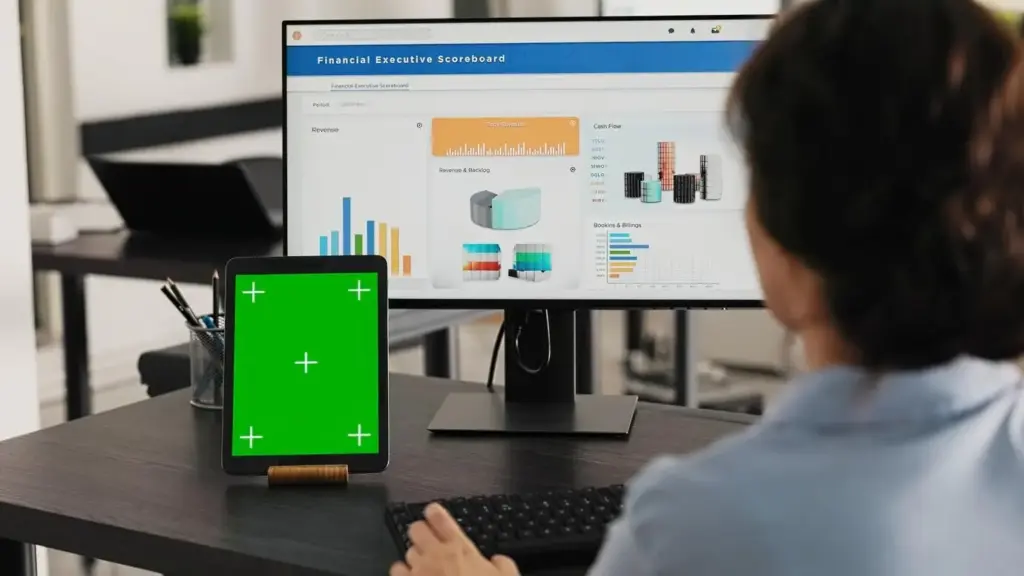

A Dashboard You Can Read at a Glance