Make Cash Flow Calm, Clear, and Consistent

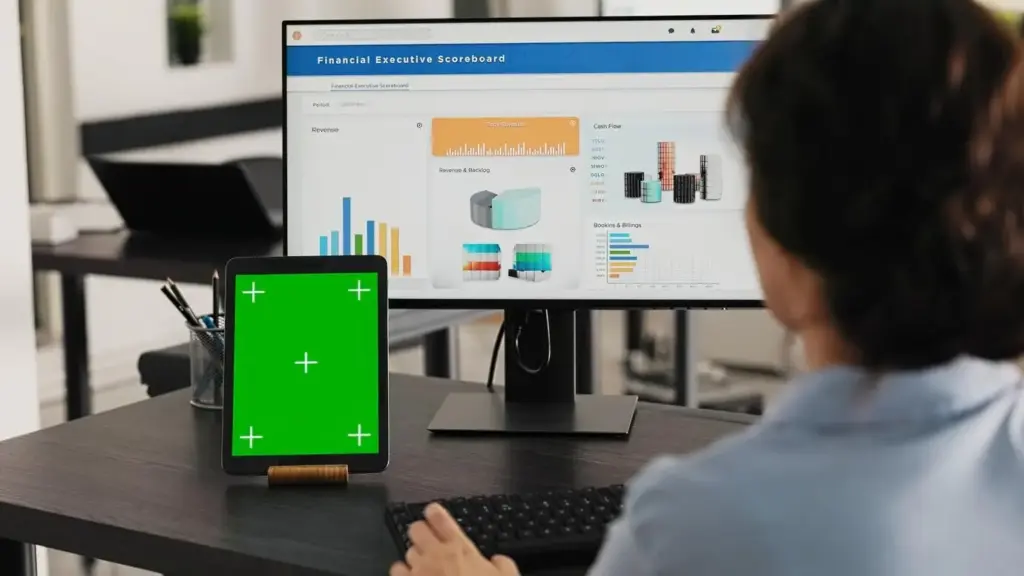

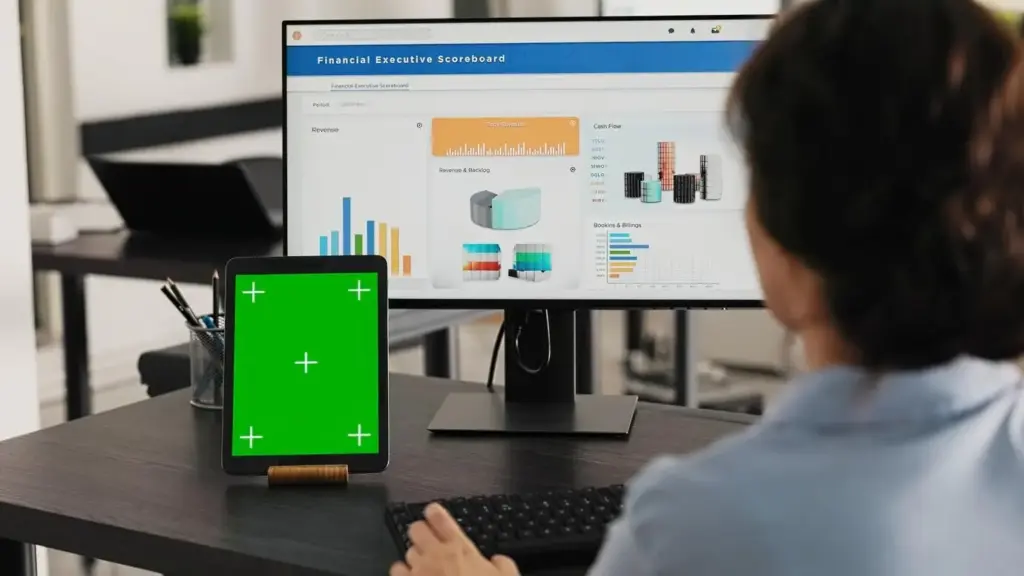

See the Whole Cash Picture

{{SECTION_SUBTITLE}}

The Cash Equation, Decoded

Accrual vs. Cash, Plainly Explained

Forecasting That Stays Honest

Get Paid Faster Without Burning Bridges

Pay Bills Strategically and Fairly

Protect Your Cushion

Build an Operating Reserve

Start small and automate. Sweep a percentage of weekly inflows into a reserve account, increasing the rate during strong months. Name the account intentionally to discourage casual raids. Set thresholds that trigger spending pauses or focused collections efforts. Even two payrolls of coverage transform stress into patience. Celebrate milestones and publish a simple policy so your team understands the purpose. A visible buffer fosters steady execution and thoughtful risk-taking.

Right-Sized Credit for Real Life

Credit is a safety net, not a lifestyle. We’ll choose a line sized to realistic swing needs, not wishful expansion. Familiarize yourself with covenants, utilization costs, and draw timelines. Practice small test draws and repayments to ensure smooth processes before urgency hits. Keep lender updates proactive and clean. Used sparingly and strategically, credit supports opportunity, protects payroll, and complements—not replaces—your cash habits and operating reserve.

Contribution Margin in One Conversation

Tiny Price Changes, Big Effects

Rituals, Dashboards, and Momentum